DAF Giving

Giving through your Donor-Advised Fund (DAF) is easy, impactful, and tax-efficient

What is a Donor-Advised Fund (DAF)?

A DAF is a simple, flexible, and tax-efficient way to support causes you care about. It functions like a charitable savings account, similar to a 401(k) for giving. You contribute to your DAF, receive an immediate tax deduction, and then recommend grants to nonprofits, such as CASA of Placer, Yuba & Sutter.

How it works

Donor gives cash or appreciated asset to their DAF

Donor then receives tax deduction

Funds are invested and grow tax-free

Donor selects timing, recipient, and amount

CASA of Placer, Yuba & Sutter receives funds

Why give through DAF?

Tax Efficiency

Maximize tax savings with upfront deductions, avoid capital gains taxes on appreciated assets, and grow your giving tax-free.

Convenience

Manage all your giving in one convenient place.

Accessibility

Many DAF providers have low minimum contribution requirements, mobile apps, and a dedicated payment option (DAFpay) that make giving more seamless.

Impact

Research shows that donors are more likely to give twice as much to the causes they love once they establish a DAF.

Give Through DAF Direct

Recommend a grant from your existing Donor Advised Fund and make an immediate impact! Clients of BNY Mellon, Fidelity Charitable, and Schwab Charitable can make a designation through the DAF Direct window on this page.

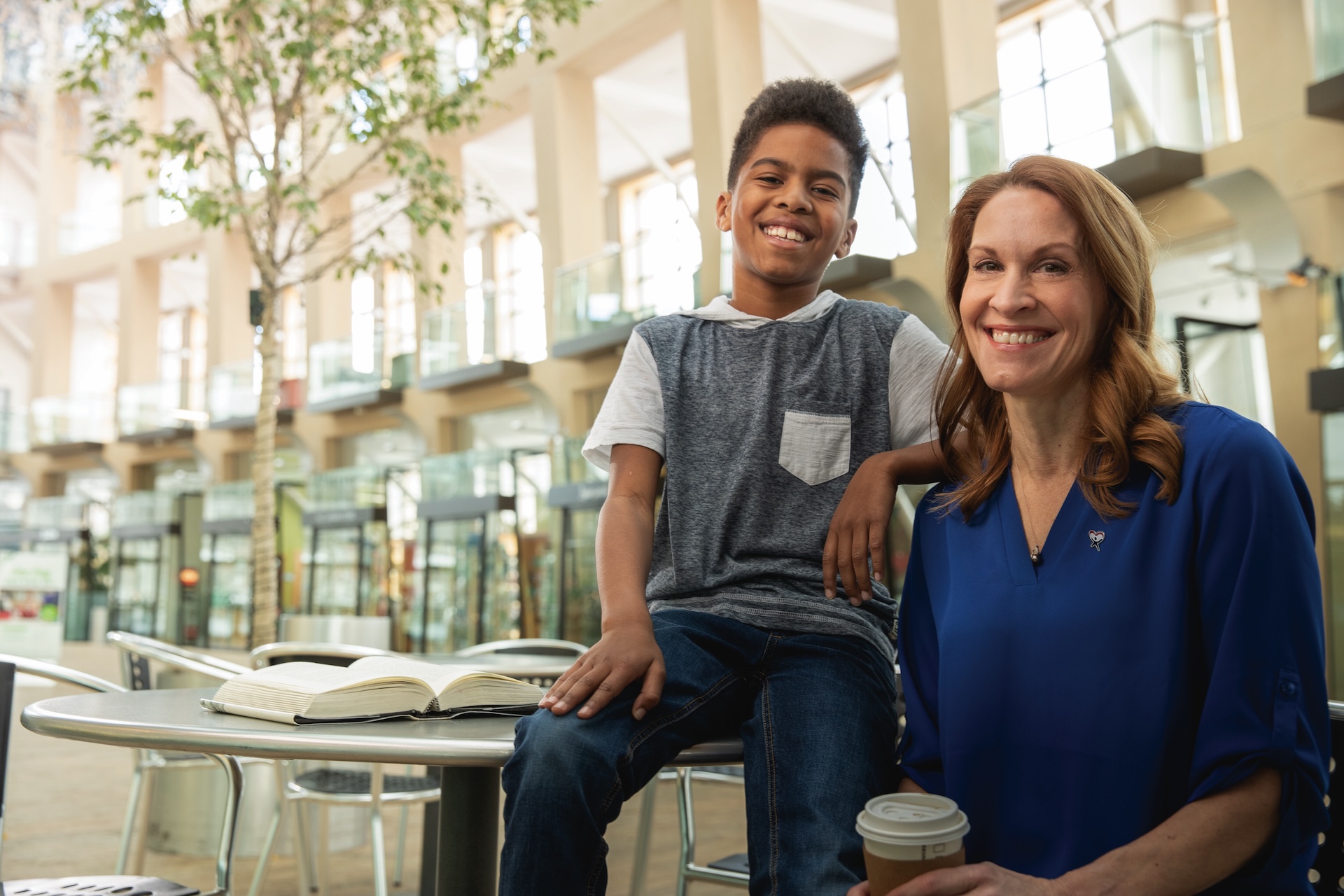

“When considering how best to support California CASA and its mission to serve foster youth, my wife and I chose to make a recurring gift through our Donor-Advised Fund. This approach ensures we can provide consistent, dedicated support. California CASA uses these resources to drive the systems change needed to improve outcomes for our most vulnerable youth. We truly believe California CASA is a catalyst for our state, for local CASA programs, and most importantly, for the children they serve.”

Zack Scott, California CASA Board Member

Don’t Have a DAF Yet?

Below is a simple guide on how to open a DAF

Step 1: Choose a DAF Provider

You can open a DAF through many financial institutions or community foundations.

Some of the most common national DAF sponsors include:

Already have a financial advisor? Ask them if your current institution offers DAFs.

Step 2: Open Your Account

Visit the provider’s website and follow their process to open a DAF account.

You’ll need to:

-

Create an account

-

Name your DAF (e.g., “The Smith Giving Fund”)

-

Make an initial contribution

Step 3: Fund Your DAF

You can contribute:

-

Cash or checks

-

Appreciated stocks or mutual funds

-

Cryptocurrency or other non-cash assets

Contributions are tax-deductible in the year they are made.

Step 4: Recommend Grants to CASA

Once your DAF is funded, you can begin recommending grants to causes you care about—like CASA!

Here’s the information you’ll need:

- Name: CASA of Placer, Yuba & Sutter

- EIN: 77-0620948

- Mailing Address: 1430 Blue Oaks Blvd. Suite 260

Roseville, CA 95747

Step 5: Repeat Anytime

You can contribute to your DAF at any time, grow your charitable funds through

investment, and recommend grants when you’re ready to make an impact.

Questions? We’re Here to Help

Contact us!

Email: info@casaconnects.org

Join Our Community

Stay connected to our community through our newsletter, event invites, and the latest updates—all in one place.

By submitting this form, you are consenting to receive marketing emails from: CASA | Court Appointed Special Advocates for Children. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact